For Investors.

Protect Your Reputation. Preserve Your Time. Maximize Recovery.

When a portfolio company winds down, the risk isn’t the paperwork—it’s the messy middle: stakeholders, timelines, asset disposition, and incomplete records that create follow-on noise for partners and LP reporting.

PhoenixExit runs a structured wind-down program with clear workstreams, predictable reporting, and tight coordination with counsel and tax, built to minimize partner time and preserve relationships.

Why Investors Should Choose PhoenixExit

Single accountable lead + escalation path

Workplan + timeline within X days of kickoff

Weekly status (RAG status, blockers, decisions needed)

Stakeholder comms pack (LP/co-investor update template, employee/vendor scripts)

Disposition plan (IP, physical assets, contracts)

Closeout binder (all filings/approvals, creditor notices, final financial package)

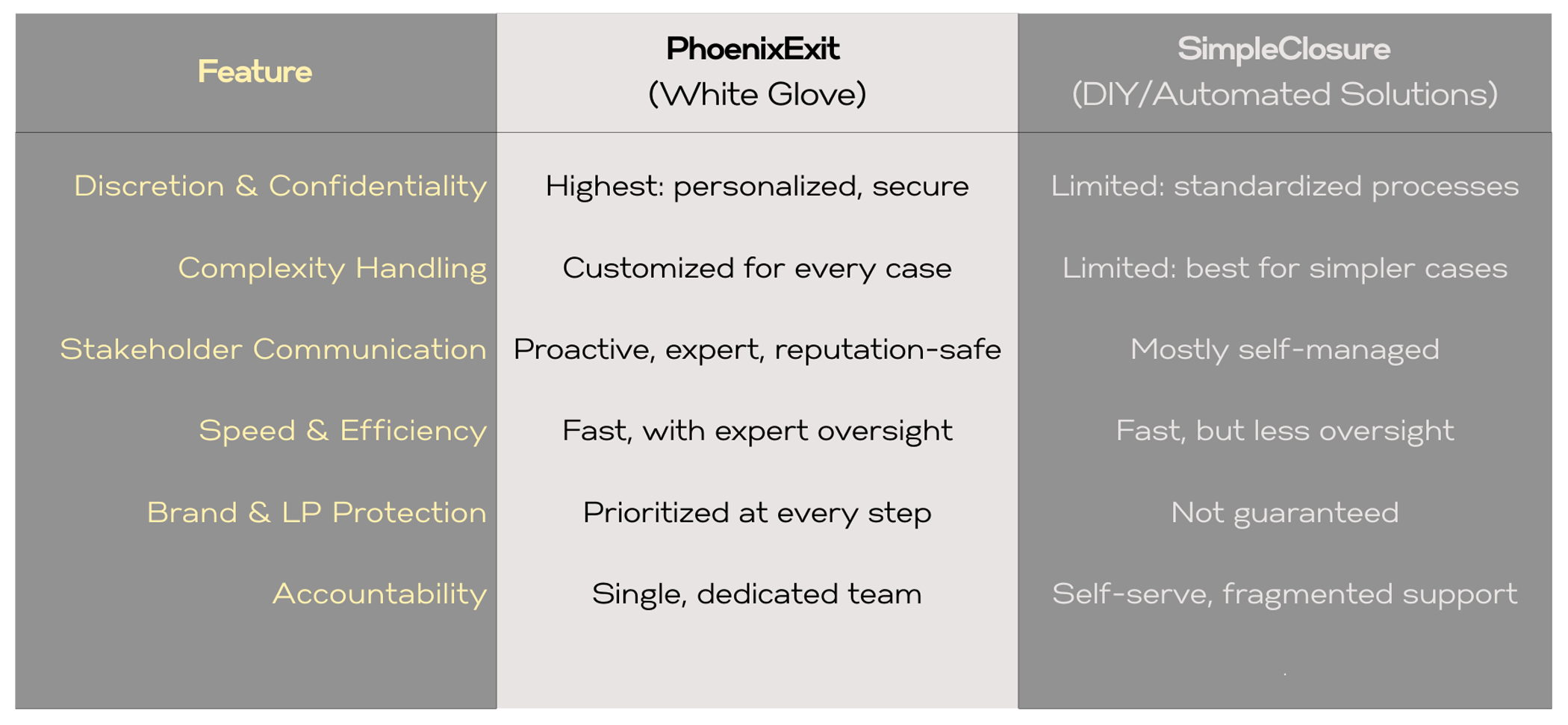

The PhoenixExit Advantage vs. DIY Automation

For the Portfolio Companies That Matter Most

When a shutdown must be handled with care, speed, and total professionalism, PhoenixExit is the trusted partner for top-tier investors. Don’t risk your reputation or waste valuable partner time on a process that deserves expert attention.

Contact us today for a confidential consultation. Let PhoenixExit make the business closure process as painless as possible for you, your limited partners (LPs), and your founders.